Perlindungan Ekonomi & Rakyat Malaysia (PERMAI) Assistance Package

19 January 2021On 18 January 2021, our Prime Minister Tan Sri Muhyiddin Yassin (“PM”) has introduced the Perlindungan Ekonomi Dan Rakyat Malaysia (“PERMAI”) Assistance Package worth RM15 billion to achieve three objectives:

- Combatting the COVID-19 Outbreak

- Safeguarding the Welfare of the People

- Supporting Business Continuity

The followings are the tax impacts on the “PERMAI” Assistance Package: -

PERSONAL TAXATION

1. Personal tax relief for private COVID-19 screening

The tax relief for medical examination has increased from RM500 to RM1,000 under Budget 2021, effective from year of assessment 2021.

The Government has now expanded the scope for tax relief for medical examination to include COVID-19 screening with the aim to support more individuals to undergo COVID-19 screening and detection tests privately.

Effective date : For year of assessment (YA) 2021

2. Extension of special personal income tax relief on the purchase of personal computer, smartphone or tablet

Based on the announcement of PENJANA, a special personal income tax relief up to RM2,500 will be given to resident individuals for the purchase of mobile phones, notebooks and tablets (not being used for the purposes of his own business) made from 1 June 2020 to 31 December 2020 as evidenced by receipts issued. This special personal income tax relief will be given in addition to the current lifestyle relief for YA 2020.

This special tax relief will be extended for another year until 31 December 2021. (^)

(^) A further clarification need to be issued from the IRB on whether a taxpayer who has claimed the special personal income tax relief in the YA 2020 will be eligible to claim for same relief in the YA 2021.

Effective date : 1 June 2020 to 31 December 2021

3. Tax Deduction for donations and contributions to the COVID-19 Fund

The Government has announced several incentives in the form of tax deductions for donors who have been assisting in cash and kind those impacted by the pandemic and the donors are eligible for a tax deduction based on their gross business income or aggregate income.

The eligible of the tax deduction for donations and contributions to the COVID-19 Fund has been outlined by the IRB via their media release dated 26 March 2020. The following contributions and donations to the COVID-19 Fund, by taxpayers, will be allowed as tax deductions.

COVID-19 Fund (Ministry of Health, National Disaster Management Agency, Prime Minister’s Department)

The relevant supporting documents required for cash contribution are as follows:

- government official receipt (kew.38);

- money transfer slip via ATM;

- cheque deposit machine slip;

- deposit slip via bank counter;

- online payment slip;

- transfer slip via interbank Giro (IGB transfer);

- receipt of Real Time Electronic Transfer of Funds and Securities (RENTAS) Systems; or

- telegraphic transfer (TT) receipt with advice of credit.

COVID-19 Fund (Ministry of Health)

The relevant supporting documents required for contribution in-kind are as follows:

- Original approval letter by the Ministry of Finance;

- Official receipt or letter of receipt from authorised body (recipient); and

- Letter of confirmation of service value / cost of project from relevant government agency.

Donations to institutions / organisations approved under Section 44(6) of the Income Tax Act 1967 (ITA 1967)*

The relevant supporting document required is as follows:

- Official receipt of the institution / organisation that has been verified by the IRB.

Note *: The above donations need to be in cash to qualify for a deduction and will be restricted to 10% of aggregate income

CORPORATE TAXATION AND UNINCORPORATED BUSINESS

4. Tax Deduction for donations and contributions to the COVID-19 Fund

Similar to Personal Taxation, please refer to above for the detailed information.

SPECIAL TAX DEDUCTION ON RENTAL REDUCTION OR WAIVER TO TENANTS

5. Special tax deduction for Landlord on waive or discounts for rentals to tenants (SME / non-SME)

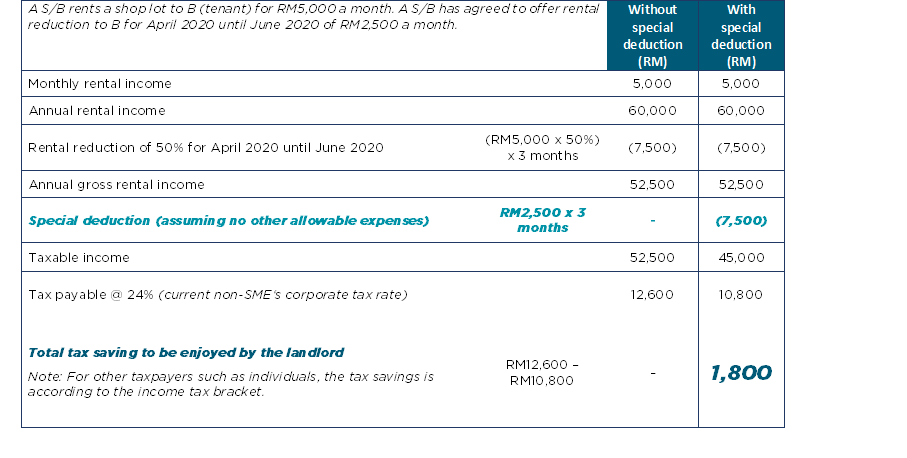

On 24 April 2020, the IRB has issued frequently asked questions (FAQs) on special tax deduction on rental reduction or waiver to Small and Medium Enterprise (SME) tenants. Landlords of buildings or business spaces that provide rental reduction or waiver to SME tenants are given a further tax deduction.

It is equivalent to the amount of rental reduction for the prescribed period (*) with condition that the rental reduction is at least 30% of the original rental rate for that particular period.

(*) Prescribed period for claiming this special tax deduction:

- Originally, the special tax deduction period is given from 1 April 2020 to June 2020 based on the IRB’s FAQ dated 24 April 2020.

- The special tax deduction period is extended until September 2020 as announced under the National Economic Recovery Plan on 5 June 2020.

- Subsequently, the special tax deduction period is further extended until March 2021 under Budget 2021.

- Under PERMAI Assistance Package, the special tax deduction period has further extended until 30 June 2021 and expanded to cover rental reduction to non-SME tenants (#).

(#) A further clarification need to be issued from the IRB for the special deduction period applicable for non-SME tenants.

Eligibility of tenants to claim this special tax deduction for the period from 1 April 2020 to 30 June 2021, the following conditions must be fulfilled:

- Any taxpayers (corporate, individual, cooperative or other business and non-business entities) renting out their business premises to any qualified tenants.

- The rented premises must be used by the tenant for purpose of carrying out his business.

O->For example: Office, workshop, warehouse, childcare and rented lot/ bazaar / booth/ stall

X->Rental of a residential house used for both residential and business is excluded

- The landlord must be a taxpayer with rental income under Section 4(a) and Section 4(d) of the ITA 1967.

Example of this special tax deduction calculation:

The supporting documents required to be kept of the taxpayers (landlords) who claim this special tax deduction are:

- Valid tenancy agreement (duly stamped);

- Rental income statement;

- Details of the rental reduction (i.e. supplementary of tenancy agreement or any written confirmation)

Effective date: To be gazetted by way of statutory order.

INDIRECT TAXES

6. Extension of sales tax exemption on passenger motor vehicles

Previously, the Government announced a sales tax exemption for locally assembled and imported passenger vehicles until 31 December 2020.

Under PERMAI Assistance Package, the Government has extended this sale tax exemption until 30 June 2021 in order to drive the growth momentum of the automotive sector.

Effective date: 1 January 2021 to 30 June 2021

7. Shorter ownership period to qualify for exercise duty and sales tax exemption for taxi owners

The Government has announced under PERMAI Assistance Package that the ownership period to qualify for exercise duty and sales tax exemption for taxi owners has now been reduced from 7 years to 5 years before the taxi owners sell or transfer the taxi for private use.

Effective date: 1 January 2021 to 31 December 2021

OTHERS (NON-TAX RELATED)

8. Wages Subsidy Programme 3.0

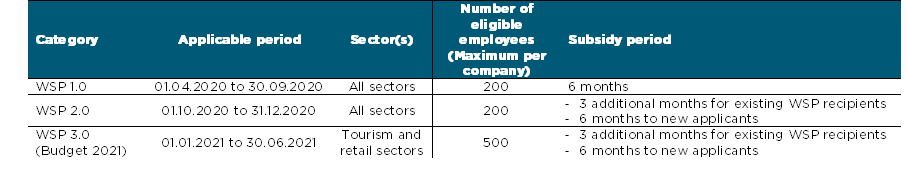

The Wages and Subsidy Programmes (WSPs) announced previously are as follows:

The new WSP 3.0 now covers employers from all sectors operating in the MCO states for a period of one month with a limit of 500 employees for each employer. The employers will be eligible to apply for a subsidy of RM600 for each of their employee with earnings less than RM4,000 per month.

9. Human Resources Development Fund (HRDF) levy exemption

For those companies unable to operate during the MCO and CMCO period, the employer levy will be exempted by HRDF.

The above information is updated as at 19 January 2021.